Invest

At the close of 2023, the Lundbeck Foundation had available funds of around DKK 23 billion. We invest to achieve the best possible return on our investments in the long term, while running the least possible risk of permanent losses.

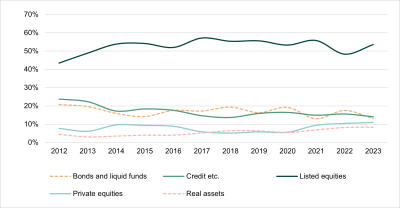

Our assets are spread across a number of different asset classes but are primarily invested in liquid shares and bonds. The aim is to generate a reliable return on the Foundation’s assets and to ensure that financial resources are available to support the subsidiaries’ development and the Foundation’s grant allocation activities. The available assets also enable us to act promptly if suitable opportunities such as potential acquisitions and investments arise.

The funds are our safeguard against times of recession. They ensure that we can continue to award our research grants even when our subsidiaries aren’t doing so well, or when our society is hit by a crisis such as COVID-19 and lately the war in Ukraine. It’s important for the research community that our grants remain stable and don't fluctuate wildly depending on the state of the Foundation

Invest consists of a team of experienced investment experts, all with a solid professional background in and an in-depth understanding of the investment universe and securities administration. We handle investments, management of securities and risk management of our investment portfolio ourselves. A proportion of our assets (approximately 33%) is invested by external portfolio managers, and we also partner with other investors to increase our investment base for specific types of investment, e.g. property through Obel-LFI Ejendomme A/S.

Asset Classes

Our available assets of approximately DKK 23 billion are invested in various asset classes, focusing on liquid shares and bonds. Furthermore, we invest in unlisted shares, credits, property and forests. Our approach is that investments must always be diversified, between sectors and asset classes, in order to reduce risk. Financial investments are shared between a diversified investment portfolio and long-term anchor investments in individual companies.

Investment Philosophy

Our investment philosophy is to apply a fundamental “bottom-up” investment process. We invest in high-quality companies with strong leadership, high profitability, good cash flow, healthy balance sheets and a persistent competitive edge, enabling long-term growth in earnings and value creation.